Navi Finserv Limited (‘Navi’) is a non-deposit taking, systemically important NBFC registered with RBI and a wholly owned subsidiary of Navi Technologies Limited (NTL).

NTL is a technology-driven financial products and services company in India focusing on the digitally connected young middleclass population of India. It offers lending products like personal loans and home loans under the ‘Navi’ brand.

- It acquired its current brand name in Jun’20 after getting acquired by Mr. Sachin Bansal led – NTL in Oct’19. Mr. Sachin Bansal presently holds about 98% stake in the company which, in turn, holds 100% stake in Navi.

- It launched personal loans product under the “Navi” brand in Apr’20. Under this business, it extends instant personal loans up to ₹ 2.0 million with tenors of up to 48 months (84 months as permissible under internal policies of the Company) through an entirely digital Navi App-only process. Since launch and up to Sep’23, it disbursed 3,671,272 personal loans amounting to ₹ 215,321.33 million. During the six months period ended Sep’23, it disbursed 1,010,761 personal loans amounting to ₹61,361.45 million, with an average ticket size of ₹60,708.

- Navi’s home loans product was launched under ‘Navi’ brand in Feb’21 to extend: (a) home loans for ready to move-in, under-construction and self-constructed properties, and (b) loans against property for constructed properties. As of Mar’23, it had disbursed home loans across 10 cities in India. It offers loans up to ₹ 100 million with a tenor of up to 30 years. As of Sep’23, the Company had an AUM of ₹ 7,257.62 million.

| Title | Details |

| Issue opens | Monday, February 26, 2024 |

| Issue closes | Thursday, March 07, 2024 |

| Allotment | First Come First Serve Basis |

| Face Value | Rs.1,000 per NCD |

| Issue Price | Rs.1,000 per NCD |

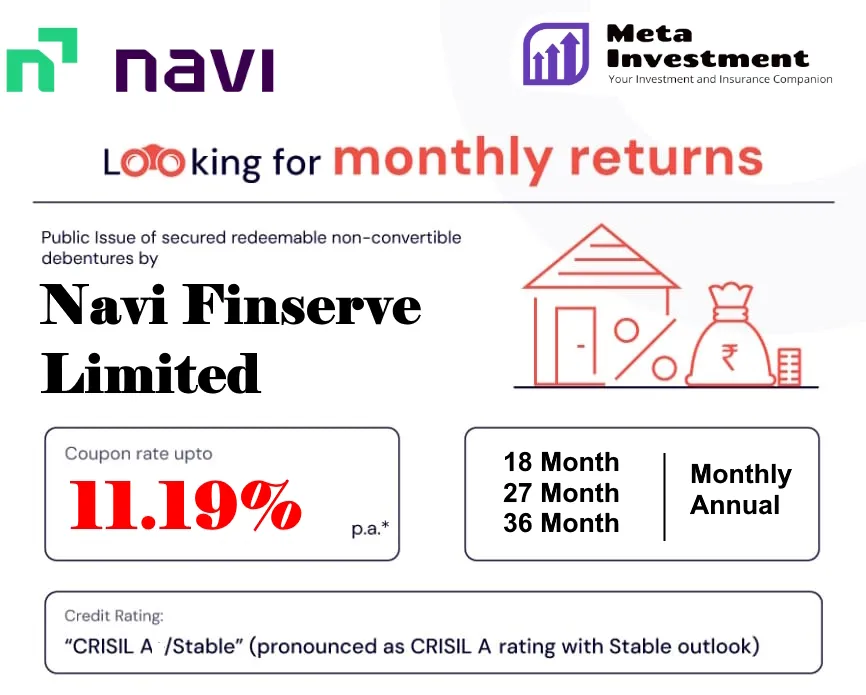

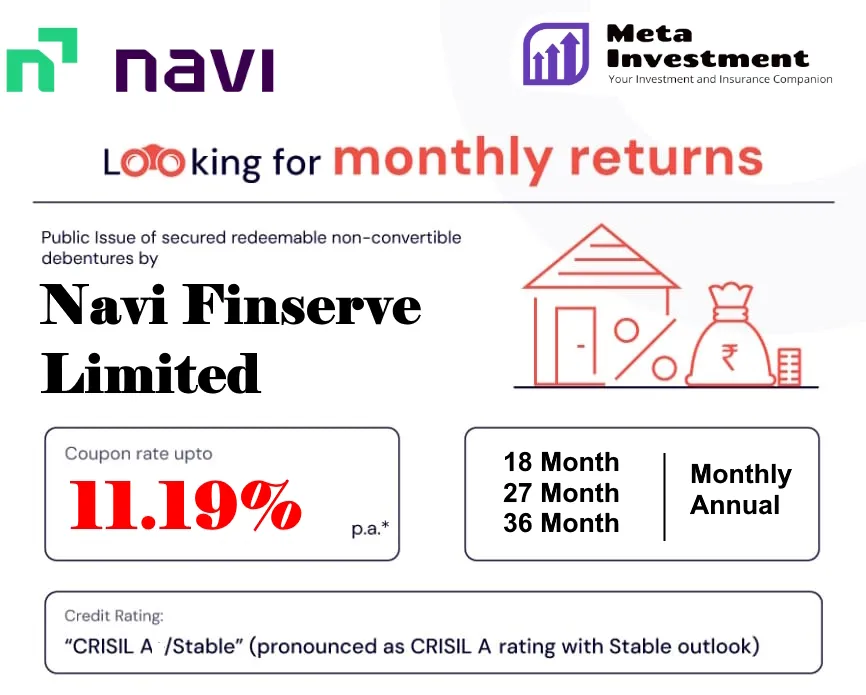

| Nature of Instrument | Secured Redeemable Non-Convertible Debentures |

| Minimum Application | 10 NCDs (Rs.10, 000) & in multiple of 1 NCD thereafter |

| Tenure | 18, 27, and 36 Months |

| Interest Payment frequency | Monthly, Annually |

| Listing | BSE and NSE |

| Rating | CRISIL A/Stable |

| Issue Size | Public issue by the Company of NCDs for an amount of ₹ 3,000 million (‘Base Issue Size’), with an option to retain over- subscription up to ₹ 3,000 million aggregating up to ₹ 6,000 million. |

Attractive Interest Rates

18 Month: 10.00%, 27 Month : 10.90%, 36 Month: 11.19%

NCD closes on March 7, 2024. Out of INR 300cr Issue size, 30% (Base 90 Crs) is reserved for Retail Individual Investors.

What should Investor do?

For investors seeking both security and high yields, this offering presents an enticing opportunity, especially given its short duration and attractive interest rates. It may be prudent to allocate a portion of your funds to this option.