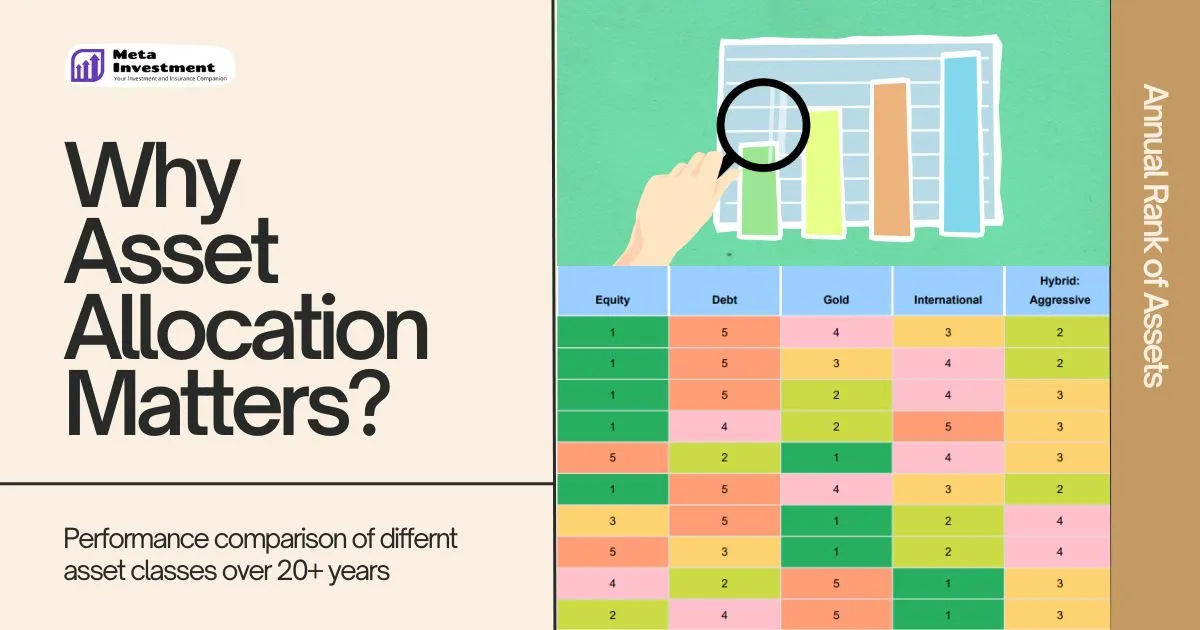

Investing is a long-term game. While the allure of quick riches and soaring stock prices is undeniable, true investment success hinges on a cornerstone principle: asset allocation.

One of the most fundamental truths of investing is that winners rotate across asset classes. Just as the seasons change, so too do the market leaders.

-

Equity (Stocks): Fuelled by economic growth and corporate profits, equities often deliver strong long-term returns. However, they are susceptible to market downturns and economic recessions.

-

Debt (Bonds): Offering relative stability and steady income, bonds provide a counterbalance to the volatility of equities. They generally perform well during economic slowdowns when interest rates tend to fall.

-

Gold: Often considered a safe haven asset, gold tends to appreciate during times of inflation, geopolitical uncertainty, and market turmoil.

-

International Equities: Investing in international markets diversifies your portfolio beyond domestic borders, exposing you to different economies and growth opportunities.

The Perils of Recent Past Bias

Investors, unfortunately, often succumb to a powerful psychological bias: recency bias. We tend to overweight assets that have recently delivered strong returns, chasing past performance. This can lead to disastrous consequences:

-

Missing Out on Future Winners: By over-allocating to recent winners, you may miss out on the next big performers.

-

Increased Portfolio Risk: Concentrating your investments in a narrow range of assets can significantly increase your overall portfolio risk.

-

Emotional Decision-Making: Chasing past performance often leads to emotional decision-making, driven by fear of missing out (FOMO) rather than sound investment principles.

The Power of Diversification: A Balanced Approach

The solution lies in diversification. By investing across a range of asset classes, you create a balanced portfolio that can weather various market conditions.

-

Risk Reduction: Diversification helps mitigate the impact of individual asset class underperformance. When one asset class falters, others may provide a cushion.

-

Enhanced Returns: By capturing the outperformance of different asset classes over time, you can potentially achieve higher risk-adjusted returns.

-

Improved Risk Tolerance: A well-diversified portfolio can help you maintain a more consistent investment approach, even during periods of market volatility.

Your Risk Profile: The Foundation of Your Allocation

The optimal asset allocation for you will depend on your risk tolerance.

-

Risk-Averse Investors: May prioritize stability and income, allocating a larger portion of their portfolio to bonds and other less volatile assets.

-

Risk-Tolerant Investors: May be more comfortable with higher levels of volatility in exchange for the potential for higher returns, allocating a greater portion of their portfolio to equities and other growth-oriented assets.

For a detailed analysis of historical asset class performance, please refer to the accompanying document titled “Asset Allocation,” which provides a table of Annual Returns of various Assets and Annual Rank of Assets in financial years from 2004 to 2024. This data demonstrates the dynamic nature of asset class performance and the importance of diversification in achieving long-term investment goals.

Conclusion

Asset allocation is not a static exercise. It requires ongoing review and adjustments based on your changing risk tolerance, investment goals, and market conditions. By embracing the principle of diversification and avoiding the pitfalls of chasing past performance, you can build a robust investment portfolio that is better equipped to navigate the ever-shifting sands of the market.

Disclaimer: This blog post is for informational purposes only and should not be construed as financial advice. Please consult with a qualified financial advisor before making any investment decisions.