Read more about

- Arudha SIF offered by Bandhan Mutual Fund

- Meta Investment | AMFI-Registered Mutual Fund Distributor | SIP & Financial Planning India

- Assets Under Management (AUM) in Mutual Funds – What Investors Must Know

- Beginner’s Guide to Mutual Funds in India – How to Start Investing in 2025

- Meta Investment Appointment Booking

- SIP, SWP, STP, PPF Calculators

- Debt Mutual Funds – A Comprehensive Guide

- Diviniti SIF offered by ITI Mutual Fund

- How Bright Can Your Diwali Bonus Shine in 2025? A Data-Backed Guide

- Diwali Investment Myths vs Reality: Insights for Pune’s Urban Investors

- Diwali 2025 Investment Offers - Illuminate Your Financial Future

- Downloads - Meta Investment

- Unlocking Wealth: The Comprehensive Guide to ELSS Mutual Funds

- Equity Mutual Funds - Types, Benefits & SEBI Categories (2025)

- Exchange-Traded Funds (ETFs) in India and Globally: A Complete Guide

- Mutual Fund FAQ's

- Demystifying FATCA: A Crucial Aspect of Mutual Fund Investments in India

- Master Your Financial Future with Our Expert-Led Webinars

- What are Floating Rate Funds? Meaning, Working, Risk & Performance Explained for Indian Investors

- Focused Mutual Fund: Concentrated Investing for Potential Growth

- Gold and Silver ETFs & Index Mutual Funds in India - Benefits, Risks & How to Invest

- Diwali 2025 Gold MLD Investment | Principal Protection & Growth for Pune Investors

- How to Choose the Right SIP Plan for Your Financial Goals | Smart SIP Investing in India

- Hybrid Mutual Fund

- Index Mutual Funds: Smart, Cost-Effective Investing for Indian Investors

- Mutual Fund Distributor & Financial Planning Services in Pune

- Mutual Fund & Financial Planning Services in Pimpri Chinchwad, Pune

- Mutual Fund & Financial Planning Services in Rahatani, Pune

- Mutual Fund Distributor & Financial Planner in Pimple Saudagar, Pune

- Mutual Fund & Financial Planning Services in Hingewadi, Pune

- Mutual Fund & Financial Planning Services in Sambhaji Nagar, Pune

- Mutual Fund & Financial Planning Services in Chinchwad, Pune

- Mutual Fund Distributor & Financial Planner in Wakad, Pune

- Introduction to Specialized Investment Funds (SIFs)

- Investment Strategies in Specialized Investment Funds (SIFs)

- ISID (Investment Strategy Information Document) for SIFs: SEBI Guidelines & Investor Guide

- iSIF SIF offered by ICICI Prudential Mutual Fund

- ISIN

- Liquid Mutual Funds: A Simple Guide for Indian Investors

- Mutual Fund Categorization and Types of Schemes: A Comprehensive Guide

- Samvat 2082 Muhurat Picks

- Mutual Fund History

- Mutual Funds

- Understanding the NAV of Mutual Funds in India

- Monthly Financial Insights Newsletter | Investment & Retirement Planning Updates

- The Importance of Nominee in Mutual Funds - Securing Your Investment Legacy

- Diwali 2025 Investment Offers - Available Now

- qsif SIF offered by Quant Mutual Fund

- Leading Specialized Investment Fund Houses in India

- SIF vs Mutual Fund vs PMS vs AIF: Key Differences, Benefits & Comparison Table

- Specialized Investment Funds (SIFs)

- SIP in Digital Gold and Silver: Celebrate Diwali Dhanteras with Smart Investing in 2025

- What is SIP in Mutual Funds? Benefits, How It Works (2025).

- SIP in Specialized Investment Funds (SIFs)

- Systematic Transfer Plan (STP) in Mutual Funds: A Smart Investment Strategy for India

- Understanding the difference between IDCW and SWP in Mutual Funds

- Thank you for registering!

- Top 5 Diwali Investment Gifts for Your Loved Ones in Pimple Saudagar

- Total Expense Ratio (TER) in Mutual Funds

- Ye Diwali Goal SIP Wali

Related posts

- The Gift That Keeps on Giving

- How To Lose 1 Crore Rupees

- Growing Their Future: Why Mutual Funds Are a Smart Investment for Minors

- Don't Panic Sell!

- Strava and SIPs: How One Cyclist Conquered Both Roads and Finances

- The Cafe vs. The Nest Egg

- Unveiling the Secrets of Wealth

- Building Your Crorepati Dream

- From Appathon to SIPathon

- The Power of Chai, SIP, and Building Long-Term Wealth

- Running, SIP and Coaching!

- EMI vs SIP

- Minor Folio in Mutual Funds: Secure Your Child's Financial Future

- Year-End Review: Mutual Fund Categories & Performance Explained

- Light Up Your Finances This Diwali: A Guide to Wealth, Wisdom, and Long-Term Prosperity

- Diwali Investment 2025: Brighten Your Financial Future with Indel Money Secured NCD | High Yield Fixed Income for Pune Investors

- World Financial Planning Day 2025: Why Urban India Needs Smart Financial Planning

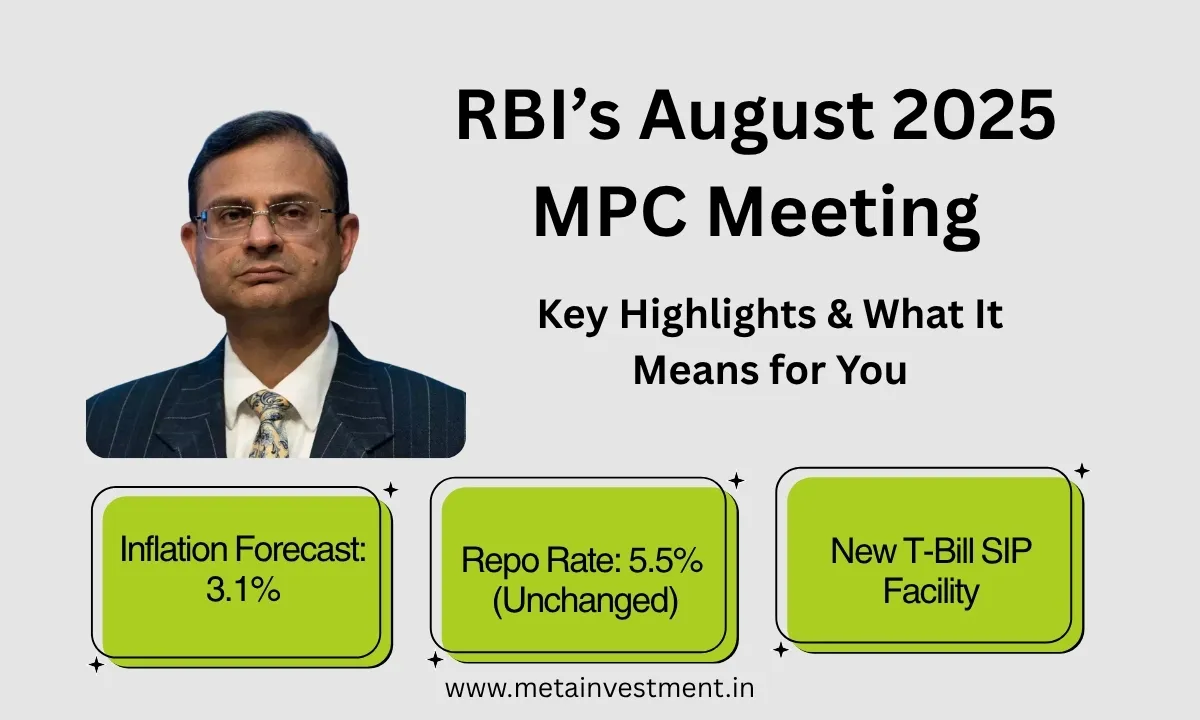

- RBI Holds Rates Steady: What the October 2025 Policy Means for Your Wallet and Investments

- The Dream and the Nightmare: Honoring Final Wishes Amid Life’s Uncertainties

- Beyond the Market Rollercoaster: A Guide to the Altiva Hybrid Long-Short SIF | Edelweiss MF

- New GST Changes 2025: Impact on Investors, Sectors, and Mutual Fund Opportunities

- India’s First Specialized Investment Fund (SIF): Bridge Between MF & PMS | quant Guide

- Tired of Market Volatility? Two New Smart Investment Ideas for 2025

- NPCI Raises UPI Transaction Limits: A Complete Guide to High-Value Payments from Sept 2025

- Tata AIA Health SIP Review 2025: A Smart Health + Investment Plan?

- Begin Your Wealth Journey This Ganesh Chaturthi: Ganpati-Inspired Mutual Fund Lessons

- ESAF SFB NCD Issue: 11.30% Coupon | Basel II Compliant Bonds

- All Weather Gold: A Principal-Protected Way to Bet on Gold (Until Aug 31)

- From Freedom Fighters to Financial Freedom: Gen Z Investing & Independence Day Lessons

- The Importance of Personalized, Transparent Financial Advice in Today’s Digital Age

- 📈💰 World Emoji Day Special: Smart Investing, SIP & Wealth Growth Made Fun! 🚀💡

- Bajaj Finserv Small Cap Fund NFO 2025 – High-Growth Investment Opportunity

- Nido Home Finance NCD 2025: Secure 10.75% Returns | CRISIL A+ Rated Investment

- HDFC Innovation Fund NFO 2025 – Invest in India’s Growth Story | Returns, Fund Manager & Performance

- From Piggy Bank to Portfolio: A Father’s Day Guide to Building Wealth

- Gold vs. Mutual Funds vs. Multi-Asset Funds: Best Investment for Akshaya Tritiya 2025

- NRI Mutual Fund Taxation: How DTAA Can Save You Tax (Anushka Shah Case)

- Understanding Beneficial Nominee in Insurance & Its Role in Estate Planning

- Mutual Will: Why Married Couples Must Have One | Estate Planning Guide

- Estate Planning in India: Wills, Trusts & Tax Tips for NRIs & Residents

- Financial Equality: How Dr. Ambedkar’s Vision Aligns with Wealth Creation

- Usain Bolt vs. Eliud Kipchoge: What Runners Can Learn About Trading and Investing

- How to Invest Like You Train: Discipline, Consistency, and Growth

- Tata AIA Shubh Flexi Income Plan: A Comprehensive Guide

- Nido Home Finance Limited NCD: A Secure Investment Opportunity

- Understanding the Global Economic Policy Uncertainty (GEPU) Index: Implications for Indian Investors

- Unlock Financial Wisdom at PIFAA Smart Money Seminar 2025 in PCMC!

- From Cricket to Code to Fitness: Investment Lessons from India’s ICC Champions Trophy 2025 Win

- 7-Day Plan for Indian Women to Kickstart Their Financial Journey: From Scarcity to Abundance

- Samudra Manthan of the Stock Market: Churning Wealth with Shiva’s Grace

- Forgot Your Mutual Fund Investments? MITRA Can Help You Find Them!

- Understanding Risk-On and Risk-Off Environments in the Stock Market

- Quality Investing Through Mutual Funds in India

- The Ever-Shifting Sands: Why Asset Allocation is Key to Investment Success

- A New Year, A New Chapter for Your Wealth

- Coming Soon, Mutual Fund Lite

- Multi Sector Rotation Fund: A New Player in the Market

- Why Now is a Good Time to Consider Target Maturity Index Funds

- Motilal Oswal Digital India Fund NFO

- Conquer Your 10 Financial Demons This Dussehara

- Understanding 1st Capital Market Index Fund of India

- 11% Edelweiss Financial Services NCD Opens for Subscription

- 5 Ganesha Mantras for Successful Investing

- Happy Ganesh Chaturthi!

- Long-Short Style Strategy: A Balanced Approach to Investing

- Bollywood Stars Shine on the 2024 Hurun India Rich List

- SIP Saheli: HDFC MF's Masterclass Empowers Women to Take Charge of Their Financial Future

- ₹800 crore Adani NCD Opens for Subscription: Is it the Right Investment for You?

- Retirement Planning for Young Indians

- Large and Mid Cap Mutual Funds: The Best of Both Worlds

- Journey to Financial Independence

- One Idiot: A Movie Where the Only Idiot is the One Who Doesn't Watch It (Probably)

- RBI Floating Rate Savings Bonds: A Flexible Investment Option for Uncertain Times

- Exciting News for Meta Investment Clients!

- Yoga of Investing with Bachat Babu

- Considering a positive outlook for TCS or Titan? These new MLDs might be for you!