As Diwali, the festival of lights, approaches, it is the perfect time for investors in Pune to kindle the lamp of financial security and prosperity.

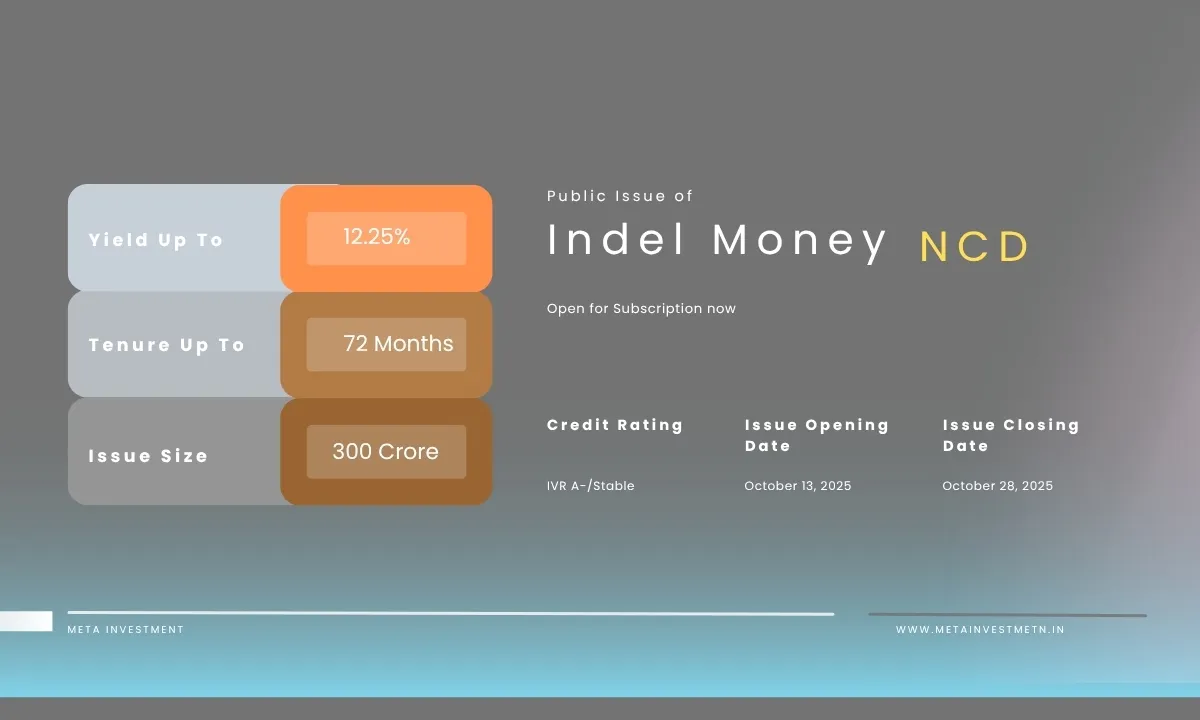

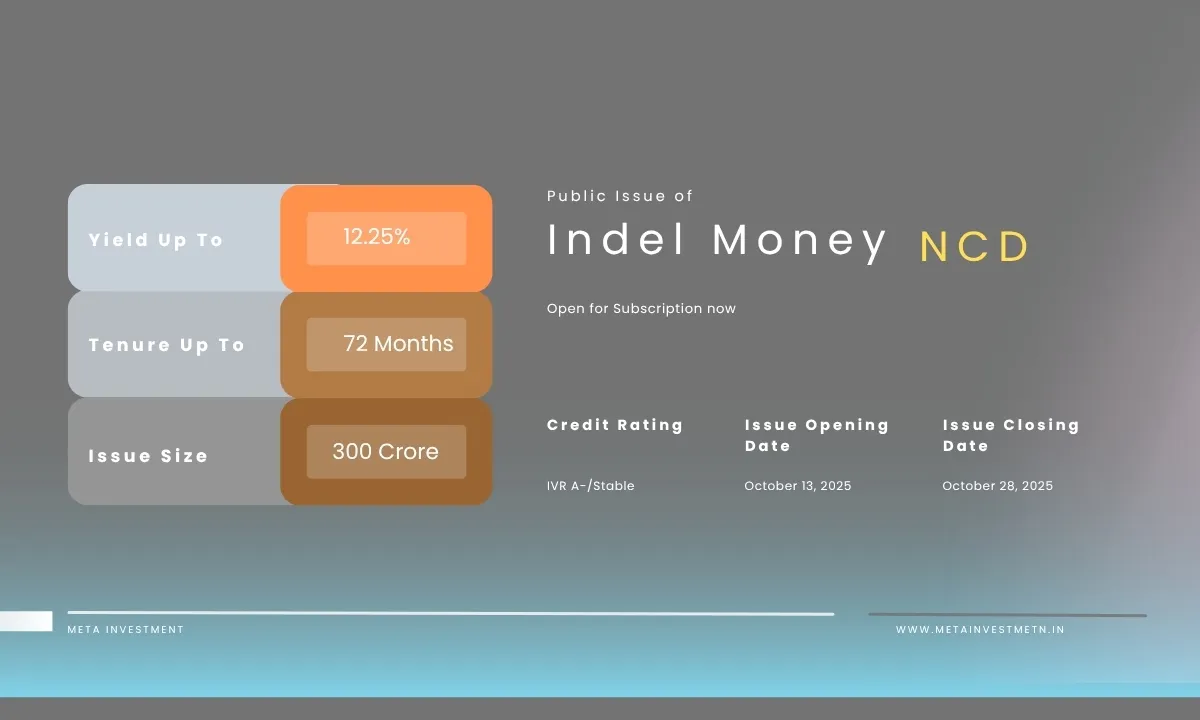

This year, alongside the sweets and celebrations, consider lighting up your investment portfolio with Indel Money Limited’s new secured Non-Convertible Debentures (NCDs) offering attractive returns up to 12.25% per annum. Indel Money Limited is a trusted name in gold loan NBFCs. This NCD from Indel Money is a secured, rated, and listed investment instrument that provides a steady income stream and a relatively safe option for fixed income investors in Pune and across India.

What is an NCD?

NCD stands for Non-Convertible Debenture — a type of debt instrument where you lend money to the company for a fixed period, and they pay you interest regularly or at maturity. Unlike convertible debentures, NCDs cannot be converted into company shares. They offer higher interest rates compared to regular fixed deposits because they carry a bit more risk.

Key Features of Indel Money NCD Issue

-

Issuer: Indel Money Limited, a reputed NBFC focused on gold loans with 373 branches and a history of steady financial performance.

-

Issue Size: ₹150 crore base with an option to raise up to ₹300 crore.

-

Credit Rating: IVR A-/Stable by Infomerics, indicating a good degree of safety.

-

Type: Secured, meaning the NCDs are backed by company assets providing added safety.

-

Interest Rates: Range from 9% to 12.25% per annum depending on tenure and payout option.

-

Tenure: Ranges from 1 year (366 days) up to 6 years (72 months).

-

Interest Payment Options: Monthly payout or cumulative (interest paid at maturity).

-

Minimum Investment: ₹10,000 (10 NCDs).

-

Listing: On BSE for liquidity.

-

Issue Dates: October 13, 2025 to October 28, 2025.

Why Should Pune Investors Consider This NCD?

In the current market scenario, where fixed income options are offering moderate yields and interest rates remain attractive with potential easing expected, this NCD stands out due to:

-

Higher Interest Rates: Up to 12.25% for longer tenure, which is competitive compared to traditional bank FDs and liquid funds.

-

Credit Rating Assurance: With an A- rating from Infomerics, investors have a reasonable comfort on risk.

-

Secured Nature: The NCD is secured, meaning your investment is backed by company assets, reducing risk of loss.

-

Company’s Financial Strength: Indel Money has shown strong growth in assets under management (AUM) and profitability, backed by experienced management and a robust branch network.

-

Regular Income: Options for monthly interest payout make it suitable for retirees or individuals seeking steady cash flow.

-

Local Accessibility: With a widespread presence including in Maharashtra and Pune regions, investor support and understanding of the local market is strong.

Understanding the Risks

Every investment carries risk, and NCDs are no exception. Key risks to keep in mind:

-

Credit Risk: Though rated A-, there is still a chance of default. If the company faces financial trouble, interest payments and principal repayment may be delayed or missed.

-

Liquidity Risk: While listed on BSE, trading in NCDs can be less liquid than stocks or mutual funds, especially in secondary markets.

-

Interest Rate Risk: Rising interest rates may reduce the market value of your NCD if you plan to sell before maturity.

-

Geographical Concentration: The company’s operations are mainly in southern India, which can expose it to regional economic risks.

Investors should read the full prospectus and consider their risk tolerance before investing.

Current Trends in Fixed Income and Positioning this NCD

With RBI signaling possible rate cuts in near future and prevailing inflation trends, fixed income investors are seeking instruments that balance yield and safety. Indel Money’s secured NCD backed by gold loan assets taps a niche with relatively stable income flow and secured backing, positioning it well among alternatives like bank fixed deposits, liquid funds, and corporate bonds.

How to Invest and Connect with Us

The NCD issue opens on October 13 and closes on October 28, 2025. Minimum application is ₹10,000 with subsequent multiples of ₹1,000. For application to invest in this NCD connect with Meta Investment.

For Pune investors seeking expert guidance, personalized investment planning, and help with application procedures, Meta Investment is here to assist. Contact us today to secure your investment in this attractive fixed income opportunity.