RBI Policy Feb 2026: Repo Rate, New CPI Series & Your Wallet | Analysis

The Reserve Bank of India (RBI) just released its first policy statement of 2026. For most of us, these announcements feel like distant math. But they decide the cost of your home loan, the safety of your bank account, and the health of your small business.

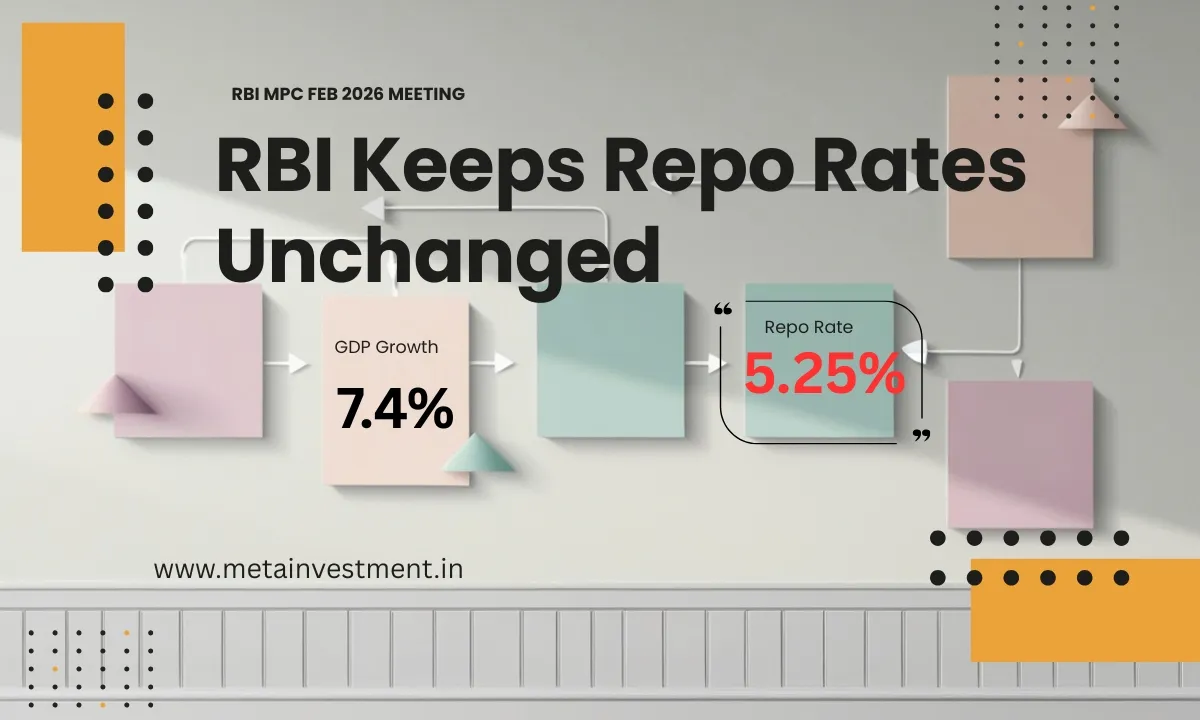

1. The Rate Stayed Still: Good News for Borrowers

The RBI kept the Repo Rate unchanged at 5.25%.

What is the Repo Rate? Think of it as the wholesale price of money. It is the interest rate at which the RBI lends money to commercial banks.

- For your Home Loan: Since the rate hasn’t moved, your EMIs on floating-rate loans (like those linked to the Repo Rate) should remain stable.

- For your Fixed Deposits: Banks are unlikely to slash FD rates immediately. If you have been waiting to lock in a deposit, now is a good time while rates remain steady.

2. A “Neutral” Stance: The Wait-and-Watch

The RBI maintained a “neutral stance”. In simple terms, this means they aren’t committed to raising or cutting rates next time. They are watching the data. Inflation is currently low, but they are wary of global tensions and rising gold prices.

3. Better Protection from Scams

In a major move for customer safety, the RBI is introducing a framework to compensate you up to ₹25,000 for losses incurred in small-value fraudulent transactions.

The Hook: If you lose money to a digital scam, you might not have to fight the bank alone anymore. The RBI is also tightening rules on mis-selling and the behavior of loan recovery agents.

4. Boost for Small Business Owners

If you run a business, getting a loan just got easier. The limit for collateral-free loans to MSMEs has been doubled from ₹10 lakh to ₹20 lakh.

- What this means: You can now borrow more for your business without pledging your house or jewelry as security. This applies to loans sanctioned or renewed from April 1, 2026.

The “New” Cost of Living: A Fresh Look at Inflation

The RBI mentioned that a new CPI series (Base 2024 = 100) is scheduled for release on February 12, 2026.

What is the “New Series” and why does it matter? Inflation is measured by tracking a “basket” of goods and services that a typical household buys. Over time, our spending habits change—for example, we might spend more on mobile data and health today than we did a decade ago.

-

Updated Weights: The new series will adjust the “weightage” of items based on the latest Household Consumption Expenditure Survey (HCES 2023-24).

-

Modern Data: It incorporates methodological changes and improved data collection to better reflect current spending patterns.

-

Better Forecasting: Because the benchmark is changing, the RBI is deferring its full-year inflation projections until the April 2026 policy to ensure they are using the most accurate data.

Updated Key Economic Indicators

| Indicator | Current Status | Impact on You |

|---|---|---|

| Repo Rate | 5.25% (Unchanged) | No immediate change in EMIs. |

| GDP Growth | 7.4% (FY 2025-26) | Strong economy generally means better job security. |

| Inflation (CPI) | 2.1% (Projected FY 2025-26) | Prices are rising slowly, though gold remains a volatility factor. |

| New CPI Series | Base 2024 (Coming Feb 12) | Will provide a more accurate picture of your true cost of living. |

Final Takeaways

-

Safety First: Keep an eye out for Financial Literacy Week starting February 9. The theme “KYC - Your First Step to Safe Banking” is a reminder to secure your accounts.

-

Borrowing Power: If you’re an MSME owner, the move to ₹20 lakh collateral-free loans is a game-changer for scaling without risking personal assets.

-

Fraud Protection: The new ₹25,000 compensation framework for digital fraud adds a much-needed layer of peace of mind for every UPI and net-banking user.

-

Real Estate: The RBI now allows banks to lend to REITs (Real Estate Investment Trusts), which could bring more professional investment into the property market.

The Indian economy is in a “good spot”. With growth high and inflation benign, it’s a stable environment for long-term financial planning.

Frequently Asked Questions

How does the unchanged Repo Rate of 5.25% affect my existing home loan?

Since the MPC voted to keep the repo rate unchanged at 5.25%, your EMIs on floating-rate home loans linked to the external benchmark should remain stable for now. There is no immediate upward or downward pressure on your monthly outgoings.

What is the new CPI series mentioned in the policy and why is it important?

The RBI is moving to a new Consumer Price Index (CPI) series with a base year of 2024, set to be released on February 12, 2026. This update will use revised weights to more accurately reflect modern household spending habits, such as increased expenditure on digital services and healthcare.

What protection do I have against digital banking frauds according to the new measures?

The RBI has proposed a new framework to compensate customers up to ₹25,000 for losses incurred in small-value fraudulent transactions. Additionally, they are working on draft guidelines to limit customer liability in unauthorized electronic transactions to enhance overall safety.

I am a small business owner. How does this policy help me with credit?

The limit for collateral-free loans to MSMEs is being doubled from ₹10 lakh to ₹20 lakh. This allows you to access higher credit for your business operations without the need to provide physical security or assets as collateral.

Why is the RBI waiting until April to give full-year growth and inflation projections?

The RBI has deferred full-year projections because two critical new data series—the new GDP series and the new CPI series—are being released later in February 2026. Waiting until the April policy ensures the forecasts are based on the most current and accurate economic data.

Are there any new investment opportunities mentioned in the real estate sector?

Yes, the RBI has proposed allowing banks to lend to Real Estate Investment Trusts (REITs). This move is expected to increase liquidity and provide a more structured way for individual investors to participate in the commercial real estate market.

What is the theme for this year's Financial Literacy Week?

The campaign starts on February 9, 2026, with the theme 'KYC - Your First Step to Safe Banking'. It emphasizes the importance of Re-KYC and maintaining updated account details to prevent unauthorized access and ensure safe banking.

(Updated: )